Every one of us wants to early retire

and retire richly. Actually, this is not an issue and all it needs is exact

planning on our Side. Here we explain

the steps one needs to take to that will make your retirement planning an easy

and rewarding exercise with almost no intrusion into your current lifestyle.

How to plan and invest for your retirement?

Retirement does not receive enough attention since, for most

individuals, retirement is at least two or three decades away. The reason why

one should have a retirement plan are

1. People are living longer than 65 years.

2. Inflation (7% in India).

3. Social Respects.

4. To avoid working even after retirement.

4. Lack of a government-sponsored social security system.

Why should you start retirement planning early?

If you have age on your side, then retirement planning can

be a very easy exercise as one needs to put in relatively low investment and

then allow compounding to do its work & garner a lot of wealth into your

retirement bucket But if you are someone who is a bit late on retirement

planning, then here are some steps that you can take starting today to close

the gap

1. Start saving more

2. Rearrange your portfolio allocation

3. If need be, increase your retirement age

4. Avoid spending on Luxuries products if your shortage of savings for retirement corpus.

How to determine your retirement corpus using the Retirement calculator?

Building a retirement plan is about answering three key questions –

1. How much total corpus is required at the retirement age?

2. How much amount do you need to invest now to achieve the total Retirement Corpus Required?

3. What will be monthly annuity get till life expectancy?

One can easily get those above-given goal plans using this retirement planning estimator.

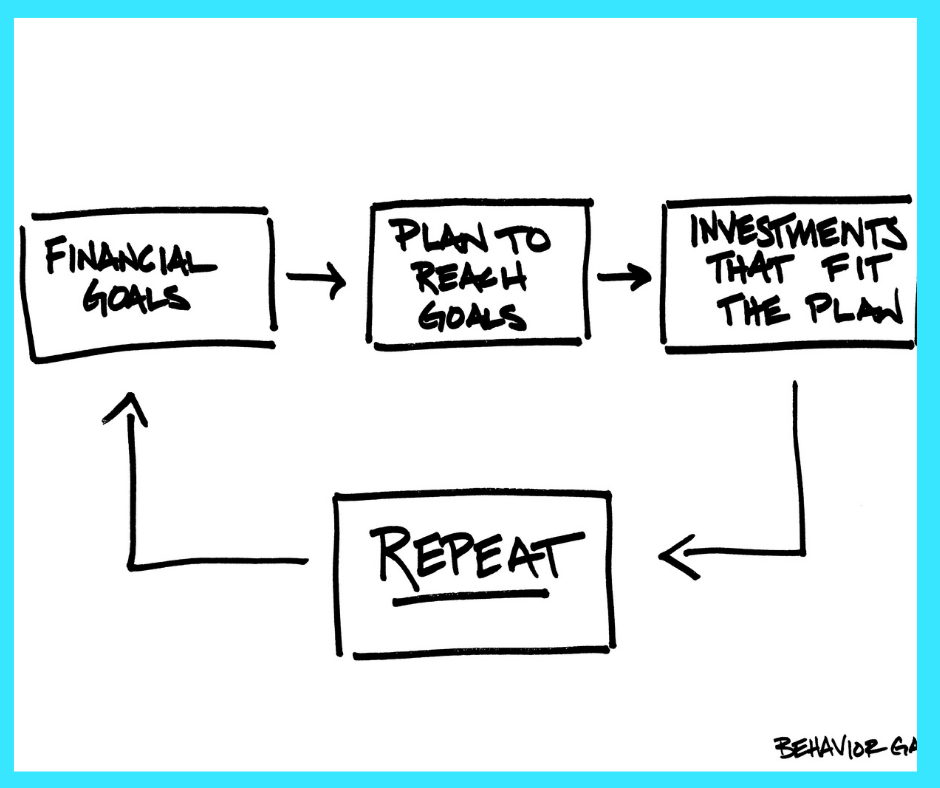

How to go about building this retirement corpus?

On the question of how much money one needs to have, there are two ways of calculating this –

a) Using the 4 percent retirement rule or

b) A more scientific retirement calculation method the idea behind the 4 percent rule was not about calculating the amount of retirement money you need but determining how much you could spend during your retirement years without the risk of running out of money.

The other scientific approach revolves around answering these five variables

1. At what age are you likely to retire?

2. What is your current monthly expenditure?

3. What is the expected rate of inflation for Pre – Retirement, and Post – Retirement? (Suggested rate 6 -7%)

4. What is the expected rate of return for the Accumulation Phase (Pre – Retirement) (Suggested rate 10-15% Mutual Funds)

5. What is the expected rate of return for the distribution Phase (Post – Retirement) (Suggested rate 8 -14% Debt and Balanced Mutual Funds)

6. What’s the life expectancy? (Expected at 85 years)

Using this free retirement calculator one can very easily get and download a retirement planning report

How to build your retirement corpus?

Creating a retirement corpus begins with determining how much adequate investable investment funds you now have and where that money will come from. The second step involves a projection of how your money will shape up.

When making forecasts, it’s critical to match the instrument to its performance predictions. Let’s not be overly aggressive with your mutual funds while creating estimates. It is advisable to be conservative. The third and last phase is to devise a strategy that will bring us closer to our desired retirement corpus. Given that this is a long-term strategy, prioritize planned and systematic investment approaches such as

Mutual funds (systematic investment plans): Mutual funds are one of the finest instruments for planning your retirement. If you consider the average CAGR of mutual fund scheme returns over the last 30 years, it has ranged from 12% to 18%. Since retirement planning is done with a long-term goal in mind, initially you can start by investing aggressively in equities funds and then switch to debt funds as you near retirement. This will ensure that you have a substantial nest fund to fall back on throughout your retirement years. For mutual funds Investment click here

Public Provident Fund ( PPF ): The Public Provident Fund (PPF) is a government savings scheme that is free from income tax under Section 80C of the Income Tax Act of 1961. Investing in PPF might save you up to ₹ 46,800 in taxes every year. You may invest up to ₹ 150,000 per year in these accounts, which have a 15-year lock-in period. Investing in PPF is a fantastic way to save for retirement since it offers an attractive rate of return. The Central Government determines PPF rates of return. They are established every quarter based on the current interest rates on government bonds. In the fiscal year 2016-17, this system was implemented.

National Pension System (NPS): The National Pension System (NPS) is a government program that aims to offer social security to the working class. Employees from the public, government, and commercial sectors are eligible to participate in this plan. Furthermore, persons working in the unorganized sector can invest in NPS. Employees will invest in a pension account at regular periods under this system.

When they retire, they can withdraw a portion of the corpus, while the remainder is paid out as a monthly pension. NPS payments are tax-deductible under Section 80C of the Income Tax Act of 1961.

Bank Deposit: Bank deposits are a traditional way to park savings and surplus funds. You have the option of making recurring deposits (RDs). These accounts allow you to invest a certain amount at regular intervals and offer a higher rate of return than a standard savings bank account. If you have a lump sum to save for retirement, you may put it in fixed deposits (FDs). The rate of return on FDs is highly appealing, and you will have accumulated a substantial sum by the time you retire.

Every earning individual should take retirement planning seriously so that they may remain financially independent in their retirement Age. When there are several plans accessible for retirement savings, a wise decision and matter of implementation.